KRA iTax guide for filing monthly VAT returns online

Wingubox (Online Accounting) takes the headache out of KRA VAT tax filing and compliance.

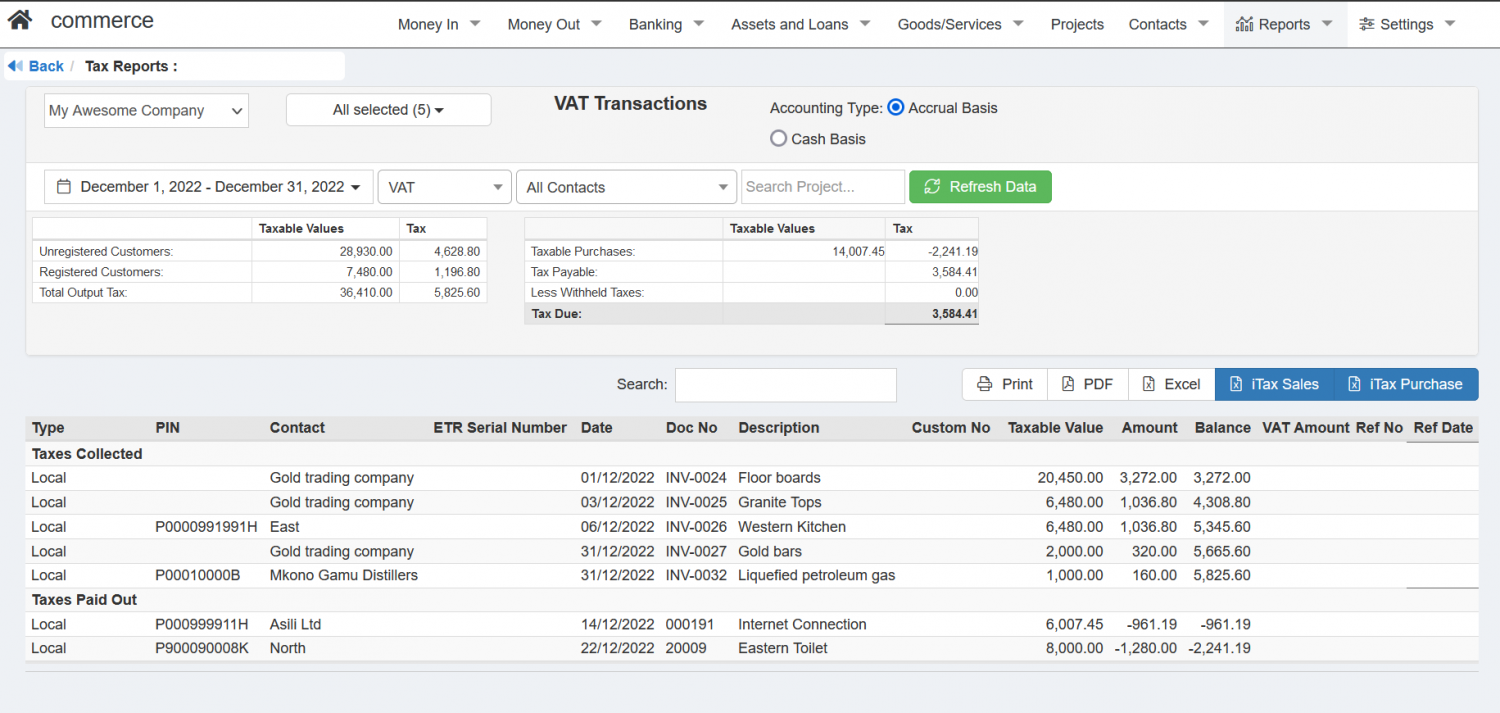

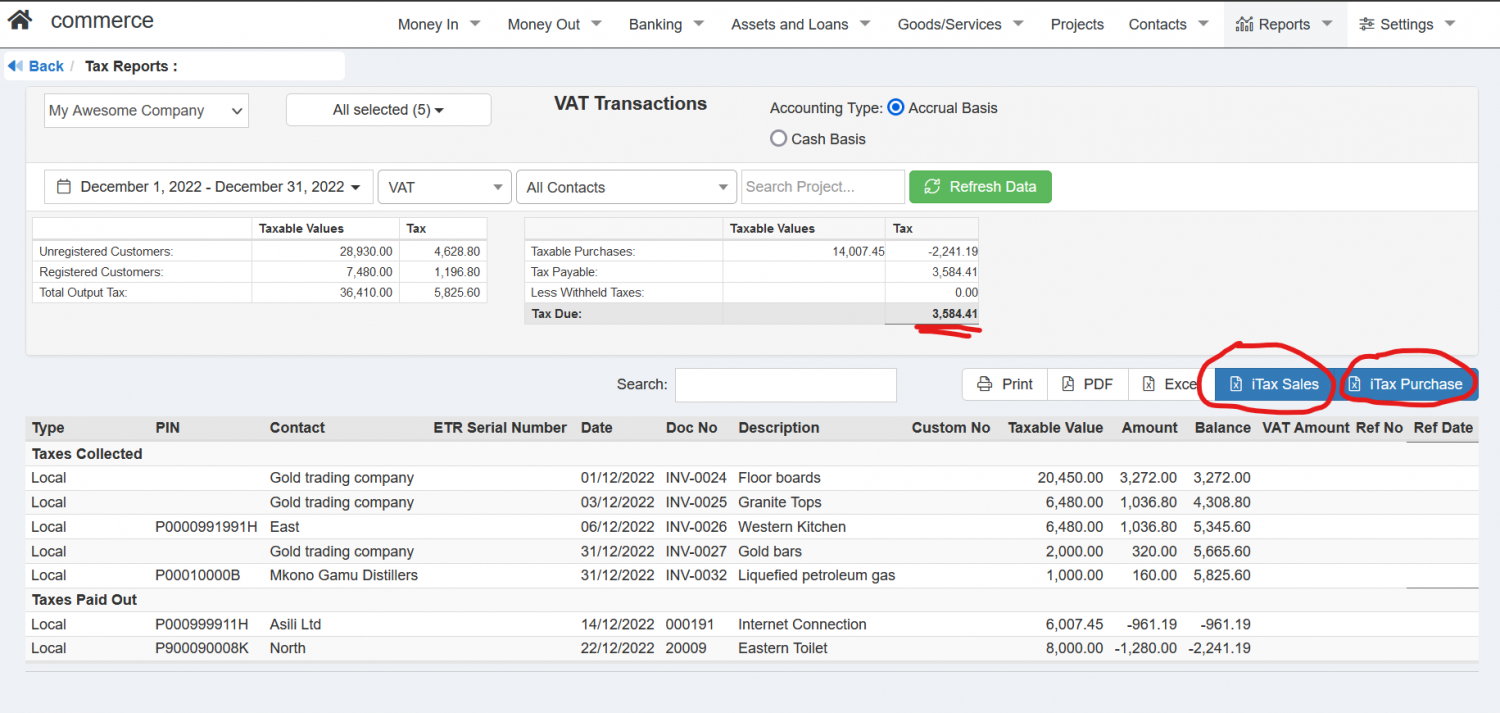

The tax report section is custom made to comply with Kenya's KRA filing format. At a glance, one can view the exact monthly tax figures.

Exporting your VAT itax data from Wingubox Commerce

- To view your VAT reports on Wingubox Online Accounting, on the menu, go to “Reports”->”Tax Reports”

- Select the desired tax, in this case VAT

- Select the desired period (It will default to last month)

- From this button you can exports two KRA itax files

-iTax Sales

-iTax Purchases

Downloading the KRA itax Excel file

- Log in to itax.kra.go.ke with your PIN and password.

- On the main menu, click on “Returns”->”File Returns”

- Select VAT as the type of tax return

- This will take you to a section where you can download the KRA itax excel file

- Download the ‘Recommended’ file format

Populating the KRA iTax file

- Open the KRA file in MS Excel and fill out the first page with details of your PIN and month of returns

- Click on the NEXT button.

- You will notice there is a tab for “General rated sales” and general rated purchases

- Under general rated purchases, import file from Wingubox for the same title.

- Notice that if you don’t have any customers with PIN, this file will have no data.

- For customers without PIN enter the full amount of vatable sales on the row labeled “Total Sales VAT for customers not registered for VAT. This amount can be gotten from the Wingubox VAT reports table.

- With “General Rated Purchases”, all invoices must have a valid registered PIN to be acceptable.

Wingubox will only export itax data where valid PINs exist.

Latest posts

New NSSF Rates for 2026

2026.02.20

New NSSF Rates for 2025

2025.02.24

Tax Laws (Amendment) Bill

2024.12.19