Tutorials

Updates in software, company and trends in the cloud technology space

18

August 2023

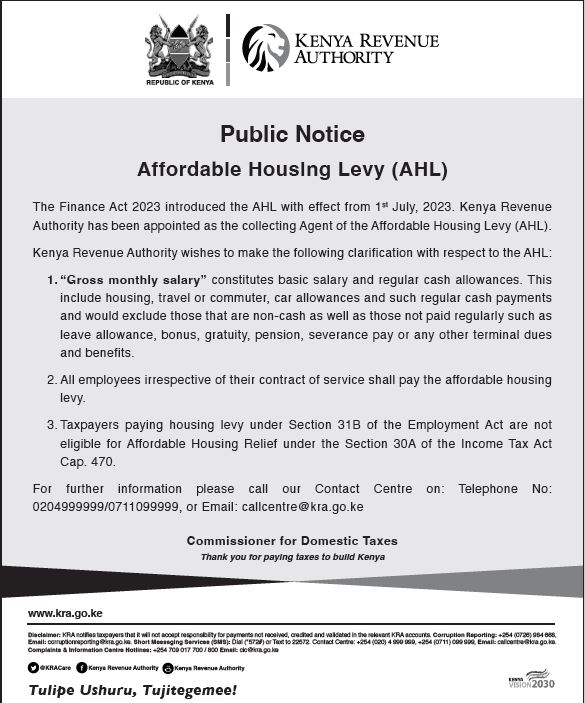

Housing Levy and Gross Salary Calculations

How to adjust Gross Monthly Salary for Housing Levy on your Wingubox Payroll (Kenya) Software Account

03

August 2023

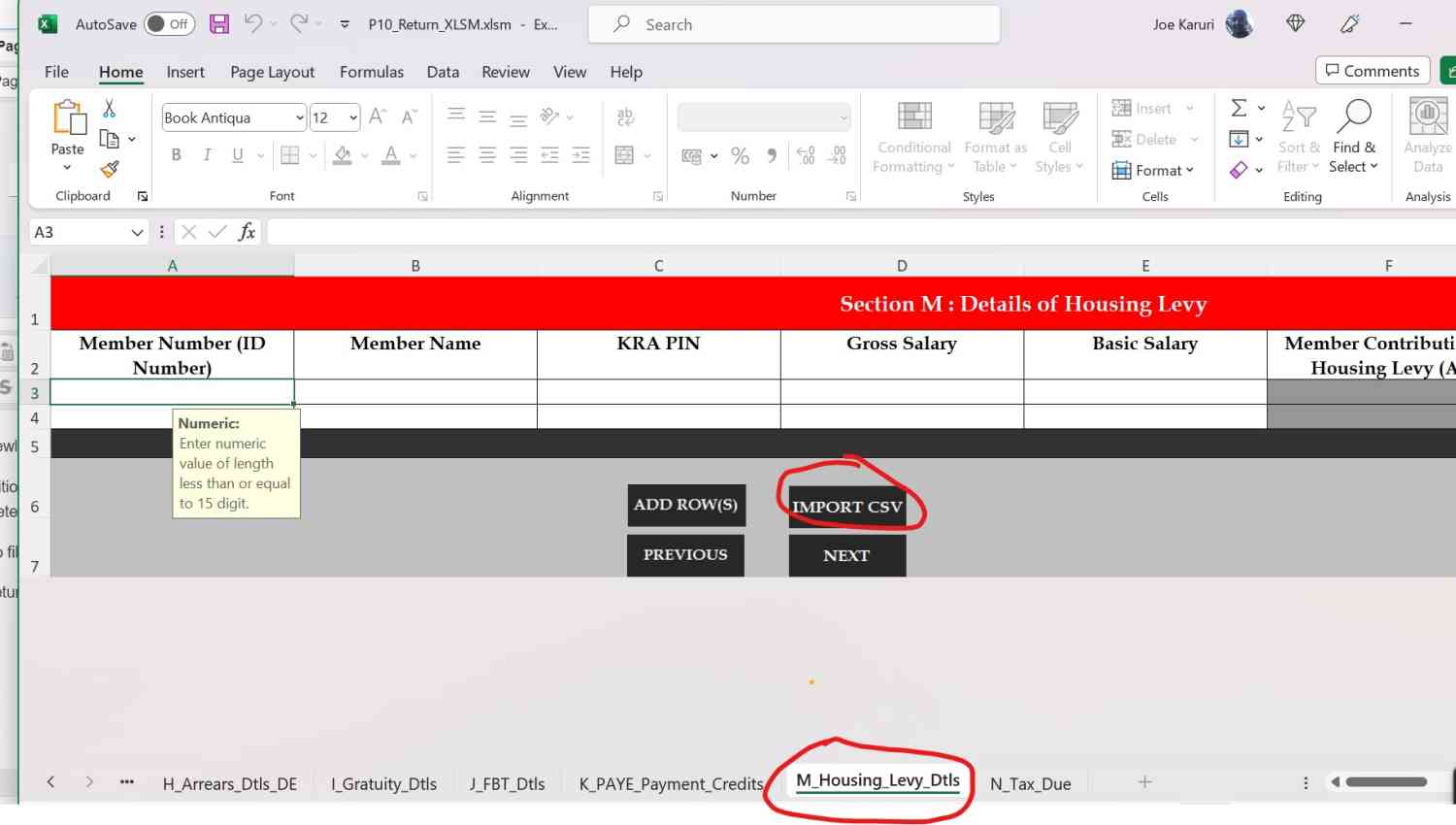

How to file returns for housing levy

Use your Wingubox KRA reports section to file your housing levy monthly returns

31

July 2023

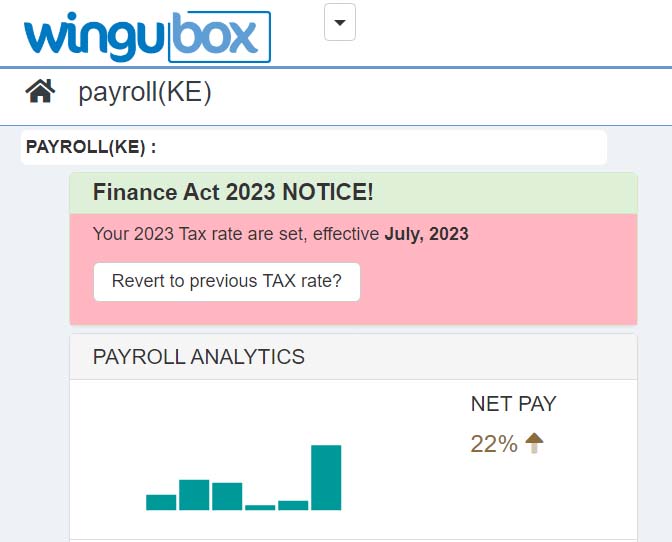

Court lifts ban on Finance Act 2023 - Kenya

Court lifts ban on finance act 2023. Here is how it will affect payroll.

25

January 2023

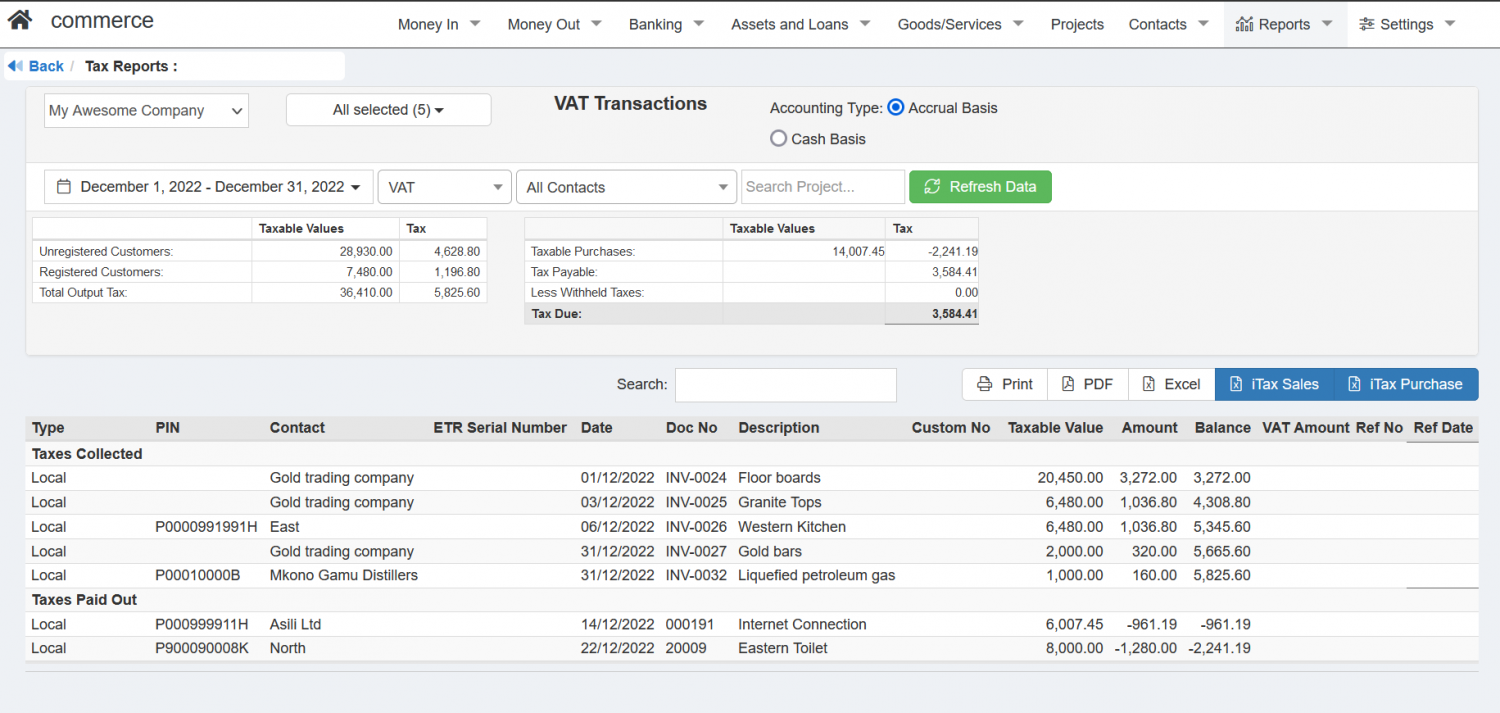

KRA iTax guide for filing monthly VAT returns online

Wingubox Online Accounting allows you to export KRA iTax format VAT returns from your monthly sales and purchases data to VAT3_Return.xlsm file

29

August 2022

Employee Attendance for Payroll

An attendance management system is important for various reasons, chief among them: Effective distribution of attendance-based resources Compensat...

08

August 2022

Salary Advance on Wingubox Payroll Software

It is common practice for employees on monthly pay to request an advance on their salary in the middle of the month. Automation of such a common task ...

03

August 2022

Employee Losses/Damages

In some cases, based on certain conditions, it may be required that an employee pay for loss or damage to employer’s property left under their c...

27

November 2019

Wingubox Expense Claims

Configure your expense claims settings This can be done by administrator with access rights to Wingubox Payroll. On the menu, go to “Settings&...

27

November 2019

Configure Employee Self-Service Access

Wingubox Payroll and HRM applications have advanced employee self-service functionality. Moreover, Wingubox gives administrators the ability to config...

08

January 2019

Understanding the Kenyan PAYE calculator

Anatomy of Kenyan Payslip. Understand how Kenyan payslips work. Including gross salary, deductible reliefs such as nssf, personal reliefs, income tax ...

12

November 2017

8 Easy Steps: How to pay NSSF Online

Learn how to use the new NSSF Kenya Self-Service Portal to upload your payroll data, generate and submit SF24 file, produce and print payment order an...

29

October 2017

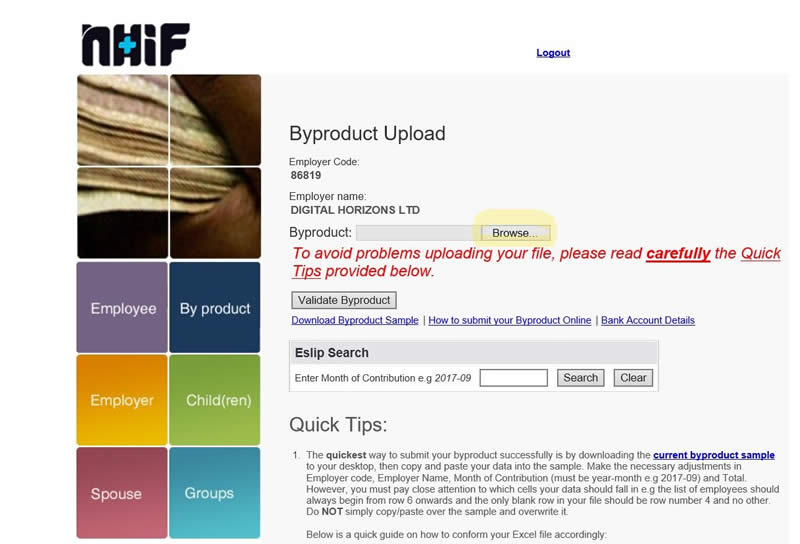

5 Easy Steps: How to make NHIF byproduct online payment

Step by step tutorial shows you how to use NHIF online resources for employers to file your monthly returns using the Byproduct Excel Sheet. Wingubox ...

23

August 2017

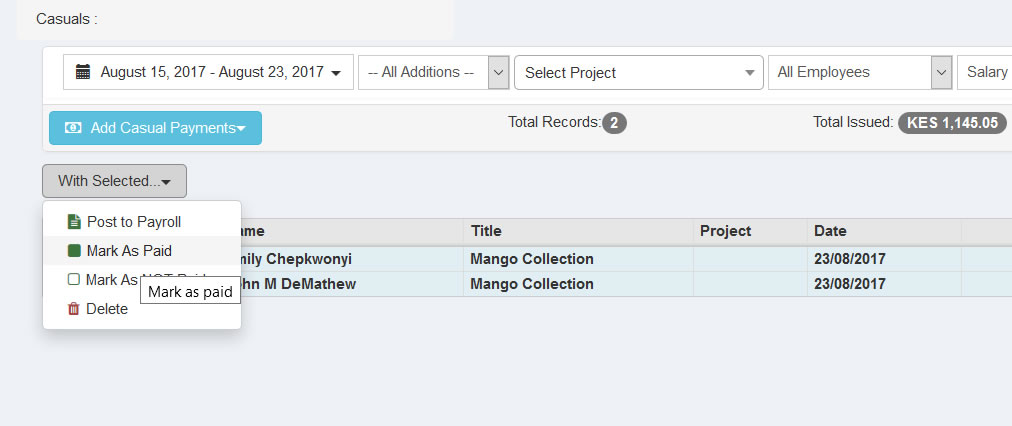

Managing Casual Employees (labourers)

Casual employees (laborers) are unpredictable. Yet the Kenyan employment and tax laws require that employers should collect statutory deductions from ...

10

April 2016

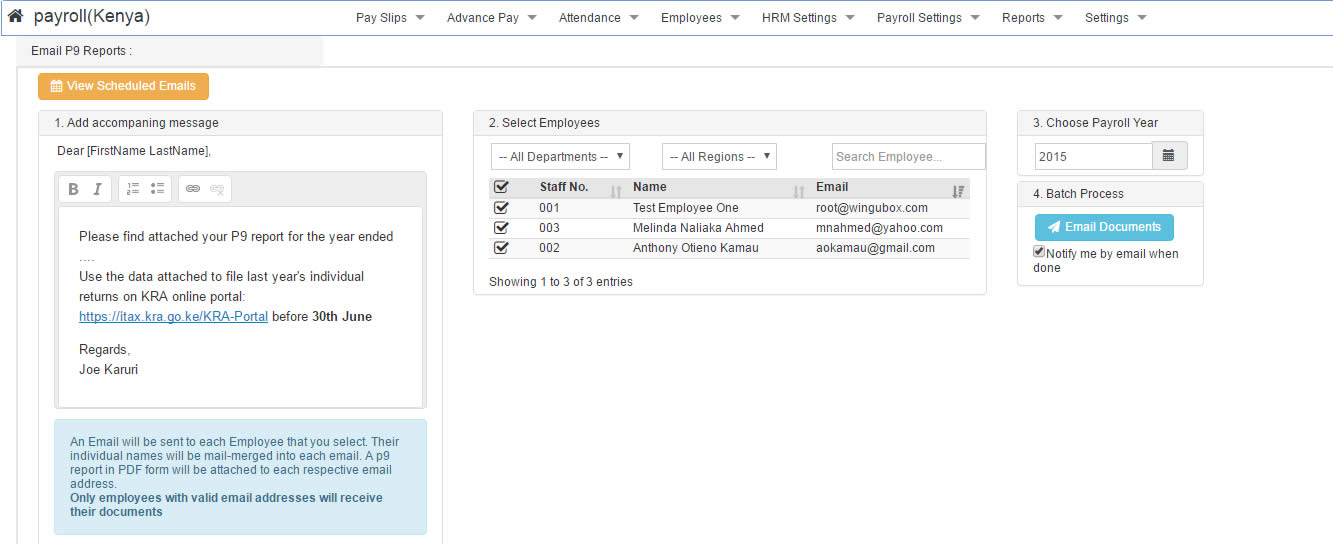

Email KRA P9 Reports to employees

Every individual is required to file their individual income tax returns online via KRA itax portal. For employees, the information for their tax retu...

08

January 2016

iTax returns: 3 most important email notifications

3 important emails to look out for while filing and paying your monthly KRA returns

22

July 2015

Wingubox User Access Levels

Application Access Level Tasks Litebooks Data Entry Can add documents (e.g invoices, receipts, vouchers, pe...

20

May 2015

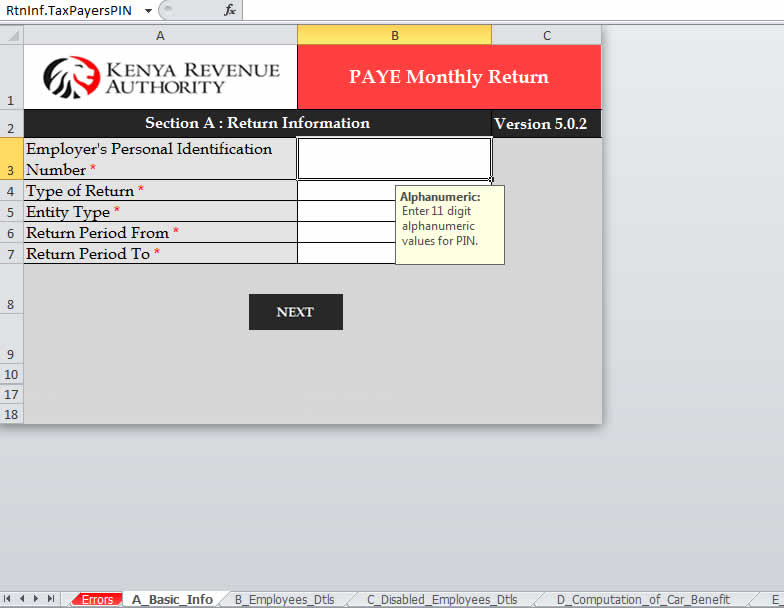

KRA iTax guide for filing P10 (PAYE) employee returns

Wingubox Online Payroll allows you to export KRA iTax format P10 (PAYE) returns from your monthly payroll data to P10_Return.xlsm file

01

October 2014

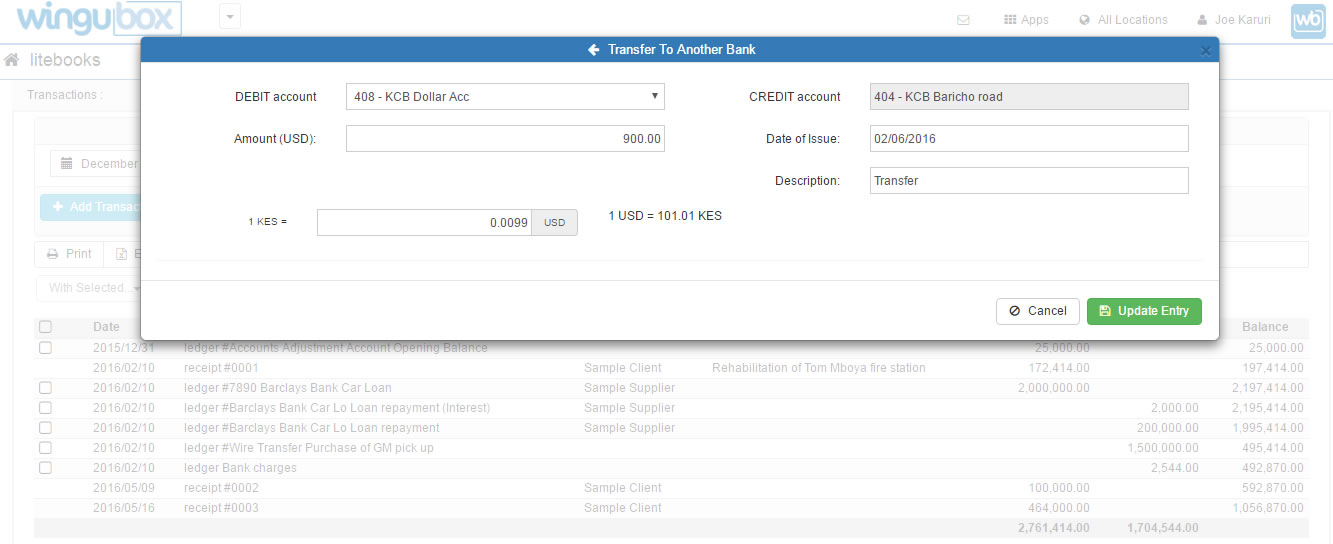

Interbank Transfers with different currencies

How to handle mutli-currency bank accounts on wingubox litebooks accounting application

21

July 2014

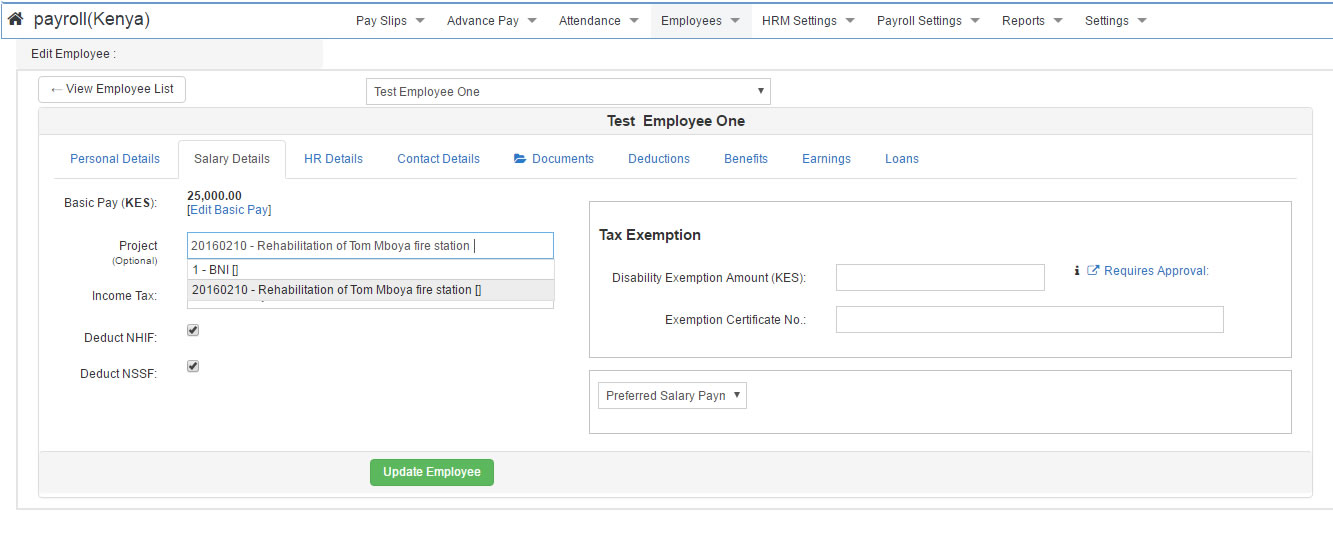

Project-based payroll reports

Wingubox Online Payroll allows you to segment your employees into projects and produce project-based payroll reports.

28

April 2013

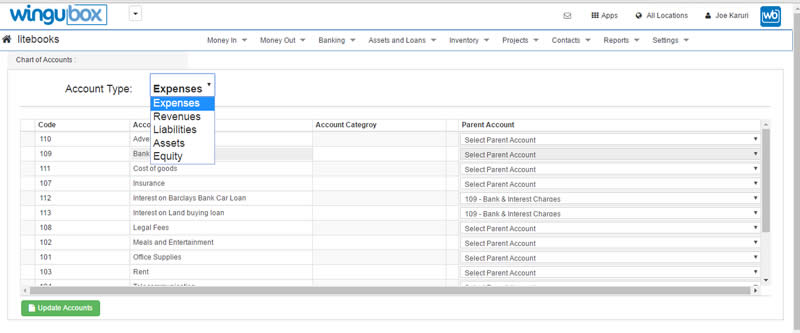

Accountants Tools

Chart of Accounts This section is mainly used by your accountant to categorize your accounts into Assets, Expenses, Equity, Revenues and Liabilities....

28

April 2013

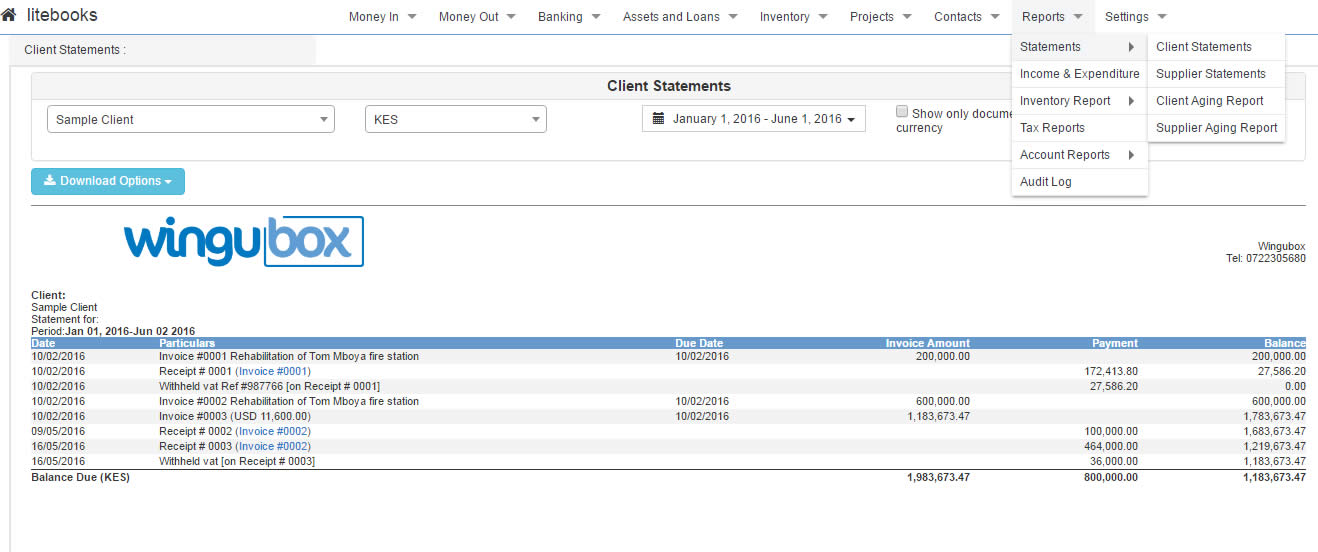

Client Debt Management

Account Aging Report As your business grows, your list of debtors also grows and becomes more complex to track. An aging report will help you categor...

28

April 2013

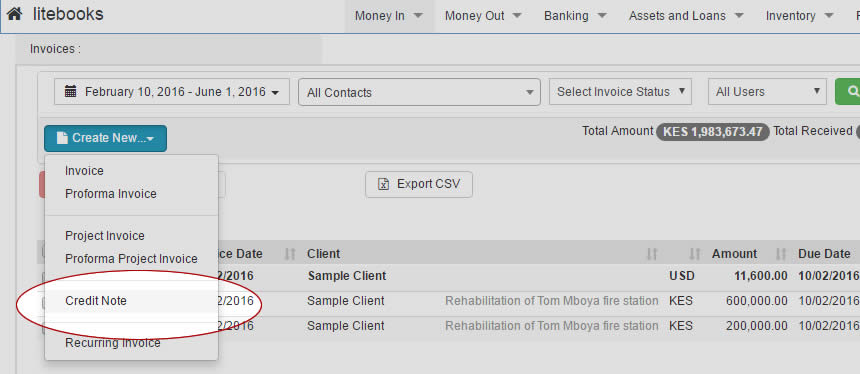

Credit Notes

A credit note can be issued to correct a mistake if the invoice has been overstated or to reimburse the buyer completely if the goods have been return...