How to file returns for housing levy

The newly introduced housing levy on the Kenyan tax payer is effective courtesy of the court of appeal lifting suspension of the Finance act 2023.

In addition to deducting and remitting 3% (1.5% employee + 1.5% employer) of gross salary to Kenya Revenue Authority (KRA), it is important that you correctly file these deductions for complete compliance.

How to file housing levy

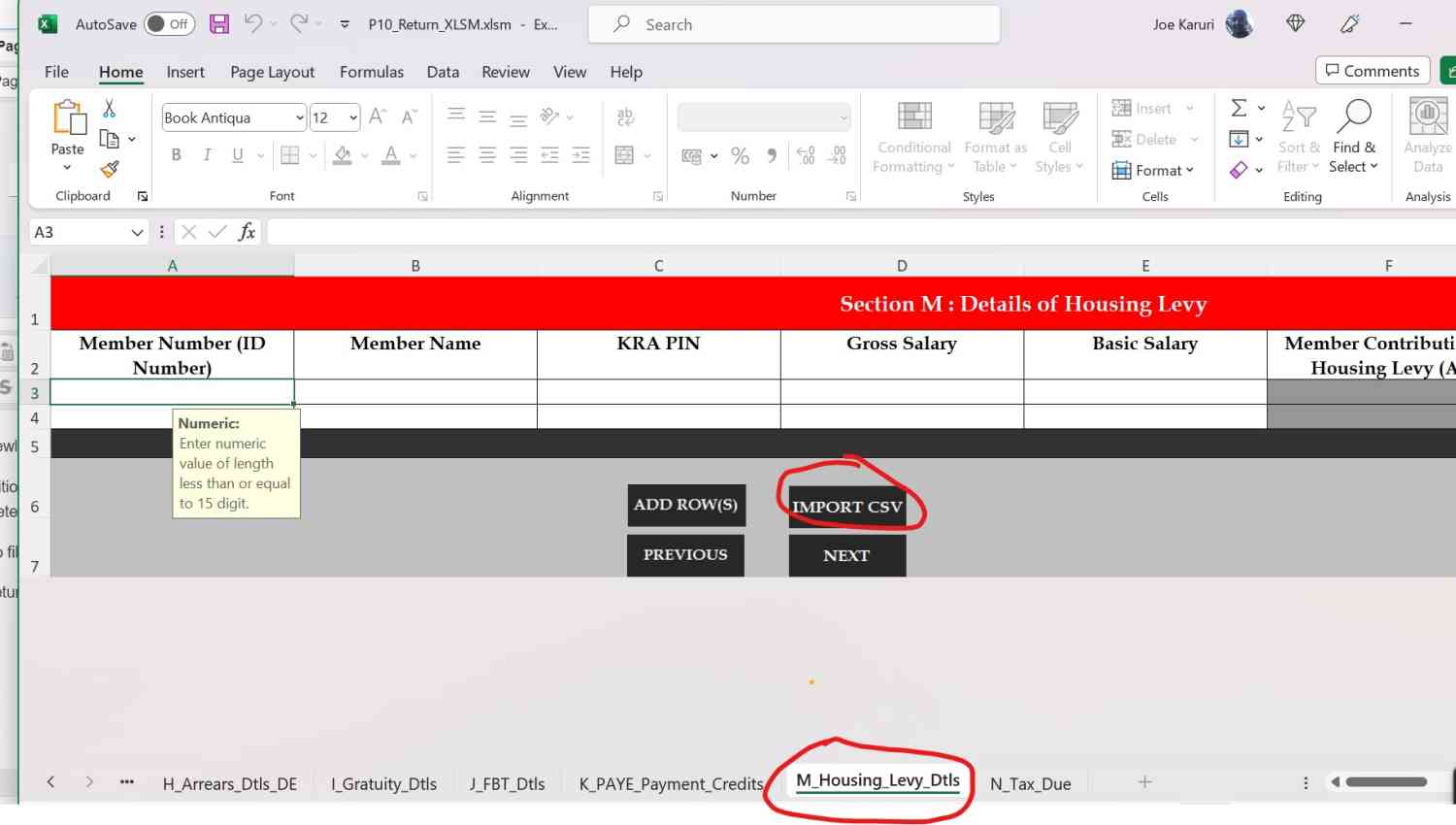

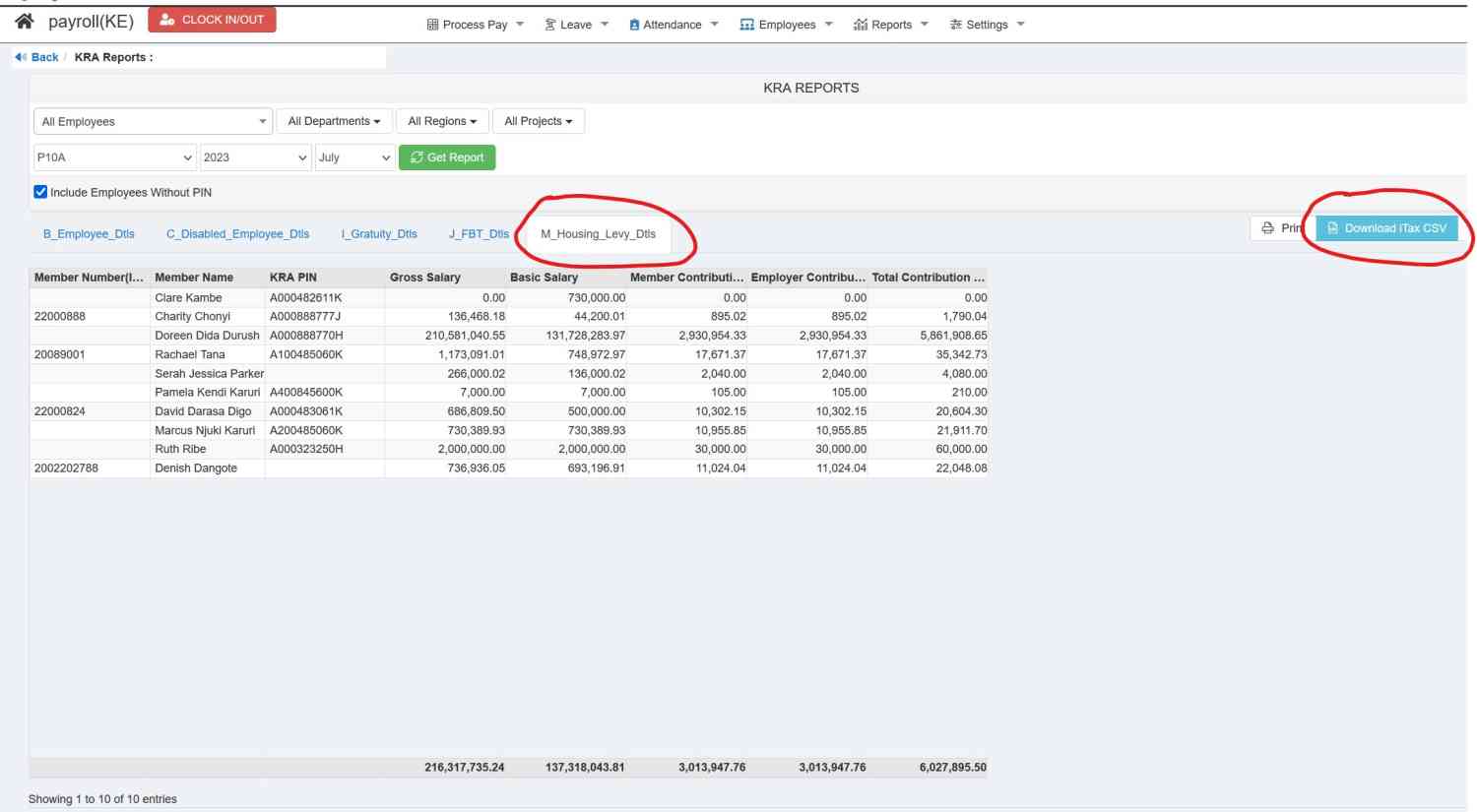

This return is filed together with your income tax (PAYE), Fringe benefit tax and NITA in your iTax form. You'll navigate to the bottom tab titled "M_Housing_Levy_Dtls", here you can input your data. If you are using Wingubox Payroll Software (Kenya), your import file is already prepared for your download in your KRA reports as shown below. Download the CSV file from Wingubox and import it into the KRA Excel sheet.

Latest posts