Managing Casual Employees (labourers)

Casual employees (laborers) are unpredictable. Yet the Kenyan employment and tax laws require that employers should collect statutory deductions from this unique group of employees.

Further, calculating payments vary significantly month on month, while payment rates may differ from one casual laborer to the next.

Wingubox Casuals, helps you streamline all these into an accurately composed muster roll every month. The following are made possible:

- Piece rate earnings (e.g. per acre, per fruit, per delivery)

- Per hour and per day earnings

- Choose to calculate total earnings either as gross pay or basic pay

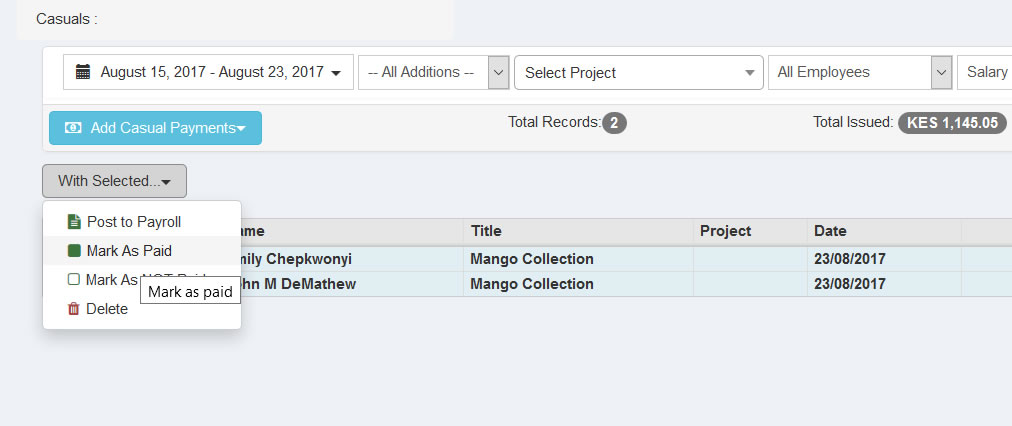

- Mark payments made

- Generate special MPESA or Bank Payment files

- Post payment data to muster roll only when ready

- Separate casual employees into projects for internal management and analysis

- Generate statutory deductions based on total monthly earnings

Piece-Rate Earnings

Daily Wages

Mark each cash payment date

Choose to treat payment as either basic pay or net pay

Final Pay Slip

Latest posts

New NSSF Rates for 2026

2026.02.20

New NSSF Rates for 2025

2025.02.24

Tax Laws (Amendment) Bill

2024.12.19