iTax returns: 3 most important email notifications

With automation of iTax, it is now easy to complete your monthly VAT and Income Tax (PAYE) returns on the KRA iTax Portal without leaving your office. Further simplification with Wingubox iTax CSV exports means even easier and less error-prone reports.

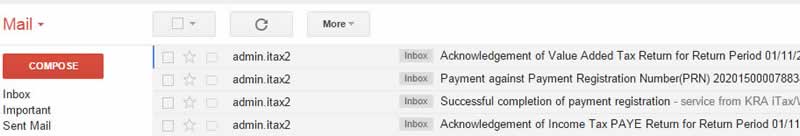

To know that you are indeed performing all the right functions on the KRA portal, there are three email notifications that you should watch out for:

Acknowledgement of VAT or Income Tax PAYE return for given month

This email notification will contain a reference number and a PDF with a summary of the returns you just filed with your iTax Excel sheet.

Successful completion of payment registration

If there are any payments due on your return, the next step is to register a payment for that return. This is essentially notifying KRA that you intend to make a payment. You’ll get an email notification containing a PDF and a Payment Registration Number. If you are paying via cheque, it is a good idea to carry the printed version of this document

Payment against Payment Registration Number(PRN)

This notification is sent after successfully completing your payment using either cheque, online banking or MPESA and referencing your Payment Registration Number generated.

Wingubox Online Payroll Software and Online Accounting software will generate your KRA csv files for you

Recommended read:

Latest posts