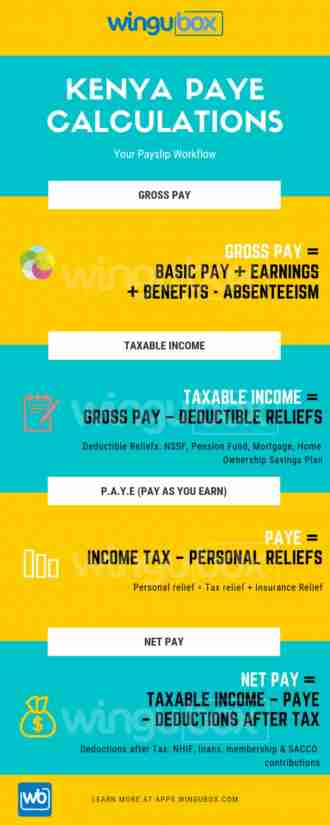

Understanding the Kenyan PAYE calculator

Gross Pay

Gross Pay or Gross Salary is Calculated by adding up:

- Basic Salary

- House Allowance

- Benefits (both cash and non-cash)

- Other earnings such as (commissions, bonuses and overtime)

- NB: You should also deduct any absenteeism penalties that would make the worker earn less that month (i.e Deductions before Tax)

GROSS PAY = BASIC PAY + EARNINGS + BENEFITS - ABSENTEEISM

Deductible reliefs

If a worker is contributing to a pension fund (retirement fund), a mortgage (owner occupied interest) or a home ownership savings plan (HOSP), they are entitled to a relief on their taxable income.

The limits on Tax Reliefs are as below:

| Taxable Income deductible reliefs | |||

|---|---|---|---|

|

Title |

Least value is the effective relief (monthly) |

||

|

Pension Fund |

Actual Contribution |

KES 20,000 |

30% of Total Pay |

|

Mortgage |

Actual Contribution |

KES 25,000 |

- |

|

HOSP |

Actual Contribution |

KES 4,000 |

- |

N.S.S.F is classified as pension fund and qualifies as a deductible relief. View new NSSF rates.

Income Tax

Income Tax Formula is calculated on Taxable Income.

TAXABLE INCOME = GROSS PAY – DEDUCTIBLE RELIEFS

Personal Reliefs

There are two types of personal relief afforded to workers:

- Tax relief – This is a standard KES 1,408 per month for every taxable income.

- Insurance relief – This is calculated at 5% of your total Life Insurance premiums to a maximum relief of KES 5,000/month

P.A.Y.E (Pay As You Earn)

PAYE is the final amount owed to KRA (Kenya Revenue Authority)

Use our online PAYE Calculator to run some numbers.

Ensure you use PAYE tax rates 2018 for payroll of 2018 moving forward.

PAYE = INCOME TAX – PERSONAL RELIEFS

Fringe Benefit Tax (FBT)

Any loan extended to an employee at interest rates lower than prevailing market rates by virtual of their employment is considered a fringe benefit and is subject to 30% of the effective benefit. This is calculated separately from Income Tax (PAYE)

FBT = LOAN BALANCE (ACTUAL INTEREST RATE – MARKET INTEREST RATE) * 30%

Try this on the Fringe Benefit Tax Calculator.

Deductions after tax

Deductions after tax are all other deductions that do not meet the criteria for deductions before tax or deductible reliefs. These will include:

- National Hospital Insurance Fund (NHIF). Here are the new NHIF rates

- Salary Advances

- SACCO contributions

- Checkoff Loans (paid through employer)

- Charges against employee (e.g. damage or loss of company property)

NET PAY = TAXABLE INCOME – PAYE - FBT – DEDUCTIONS AFTER TAX

What next?

Once you have processed your payroll, the following steps should then be taken.

- Employee salary processing

- Print or Email Payslips (also yearly individual returns p9 form emailing)

- Filing Statutory returns: How to file NHIF, How to file NSSF, how to file PAYE iTax

- Export your Payroll General Ledger to your accounting Software

Wingubox Online Payroll Software helps accountants, hr managers and business owners automate payroll tasks and auto-generate comprehensive in-house and statutory reports.

Register for 30 day Free Payroll Trial

Latest posts