New KRA PAYE Tax Rates 2018

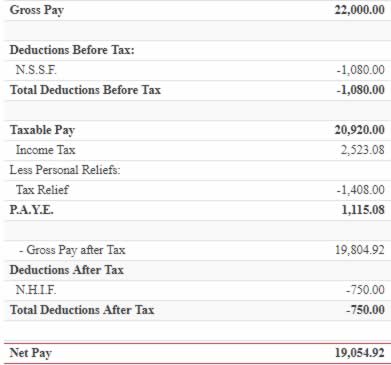

Following the implementation of the Finance Act 2017, new tax rates for Kenyan PAYE come into effect from January 1st 2018. Hence submissions for January 2018 payroll should reflect the new rates. This implementation comes just one year after a similar PAYE rate change was effected at the start of 2017. Further reading on the rates can be seen in the businessdaily and this PWC analytical article.

Below are the new monthly tax bands:

| Monthly Bands of Taxable Income (KES) | Tax Rate |

|---|---|

| 0 – 12,298 | 10% |

| On the next 11,587 | 15% |

| On the next 11,587 | 20% |

| On the next 11,587 | 25% |

| Over 47,059 | 30% |

| Personal Relief: KES 1,408.00 per month | |

| Minimum Taxable Income: KES 13,486.00 per month | |

For users of Wingubox Online Payroll Software, this formula will be automatically available in your account with the option of reverting to PAYE 2017 for historical data processing

Use our free PAYE tax calculator to see how your income has changed with the new act.

Other useful links:

Latest posts

New NSSF Rates for 2025

2025.02.24

Tax Laws (Amendment) Bill

2024.12.19

New SHIF rates for your Kenyan Payroll

2024.10.15