Employee Loans Management

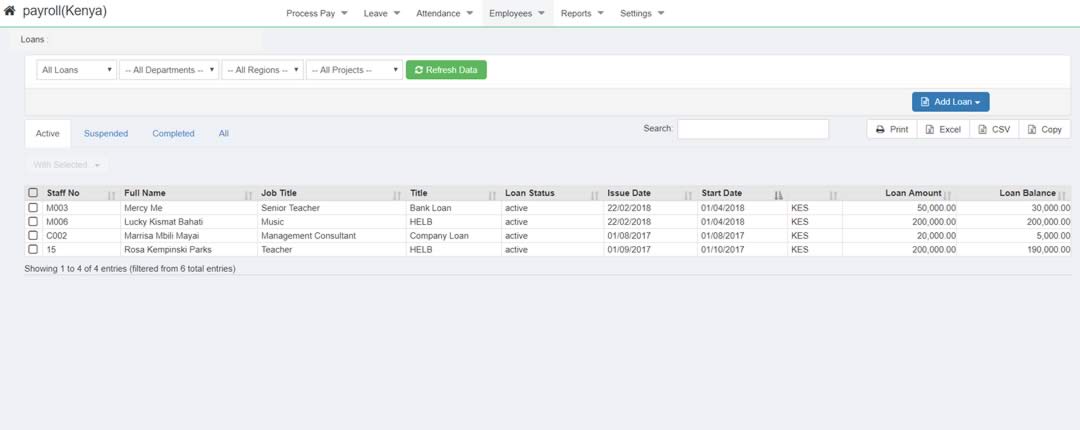

We have introduced a dedicated loans management module for easy administration of employee loans. Previously, one could only manage loans from within employees’ profiles and this had it’s limitations. Here are some of the features of the new loans management module:

- View all employee loans on one page with multiple filters

- Categorize active, suspended and completed loans

- Easily suspend, close or reactivate an existing loan

- Set a loan repayment start date

- View repayment history of a selected loan

- Enter top up amounts or manual repayments against a loan

- Enter fringe benefit tax where applicable

- Enter loan interest formula where applicable

- Export loan repayment data

To access this feature, log in and go to 'Employees'->'Payroll Data'->'Loans'

It is important to keep in mind Section 19(3) Employment Act 2007

Without prejudice to any right of recovery of any debt due, and notwithstanding the provisions of any other written law, the total amount of all deductions which under the provisions of subsection (1), may be made by an employer from the wages of his employee at any one time shall not exceed two-thirds of such wages or such additional or other amount as may be prescribed by the Minister either generally or in relation to a specified employer or employee or class of employers or employees or any trade or industry.

Not yet on Wingubox Payroll? Register for a free 30 day trial

Latest posts