KRA iTax guide for filing P10 (PAYE) employee returns

Recently, KRA has pushed businesses to go online by discouraging manual tax returns. The new iTax system is touted to make tax compliance easier and automate a number of previously manual processes.

With Wingubox, updates will be even easier with our new itax export function. You can now easily export your P10 data in form of csv file and import it onto KRA P10 excel sheet.

Below are instructions on how to achieve this.

Exporting itax data

Currently, there are two files available for P10 export:

- Employee Details

- Disabled Employee Details

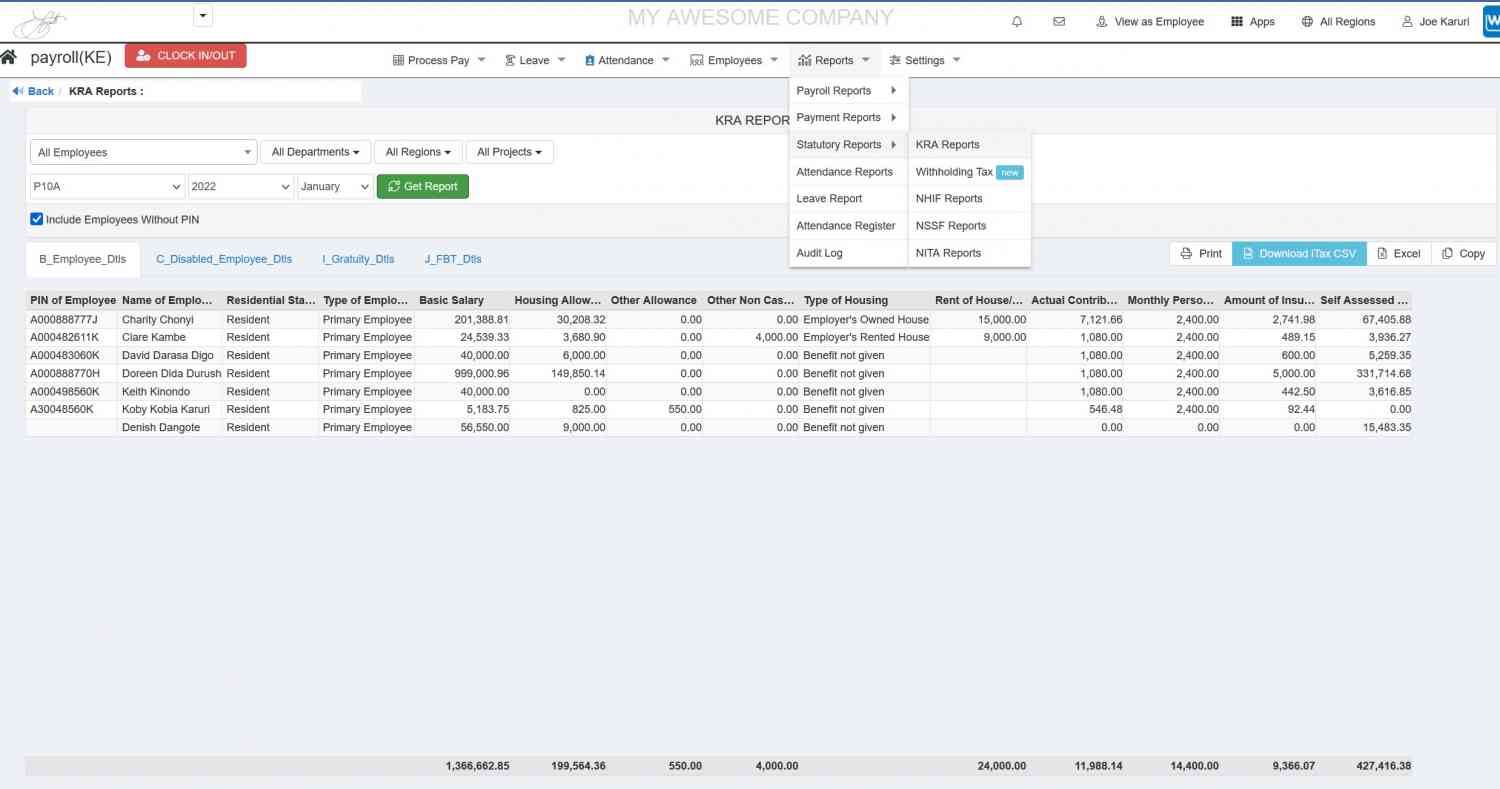

To export this, go to your payroll main menu and select "Reports" ->"Statutory Returns" -> "KRA Reports"

The default selection will be a P10 report for your most recent payroll month.

Employee Details

This file contains all your employees excluding those with disability exemption.

- Locate the blue button labeled "Download itax csv"

- Download and save the Wingubox generated csv file on your computer.

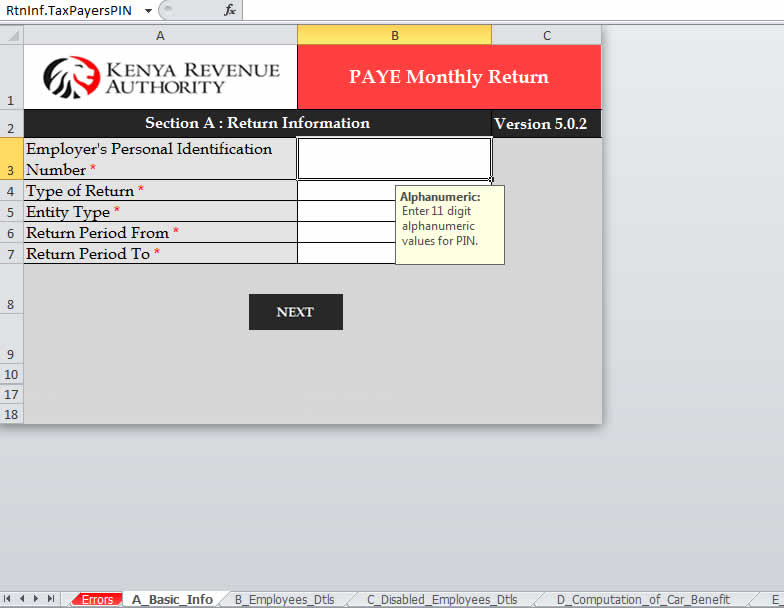

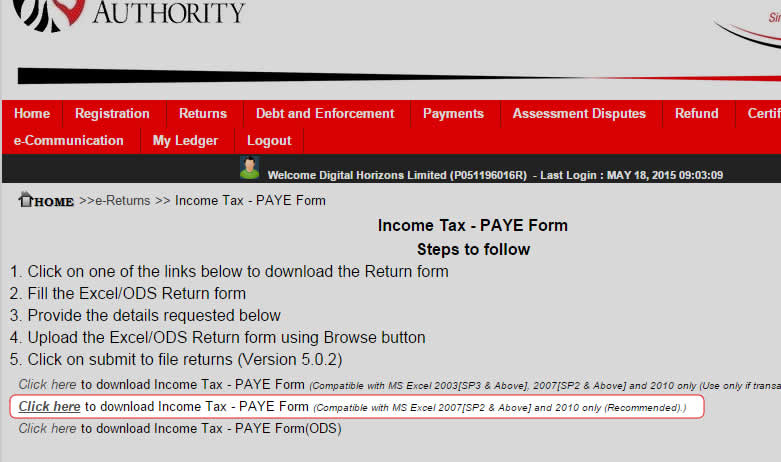

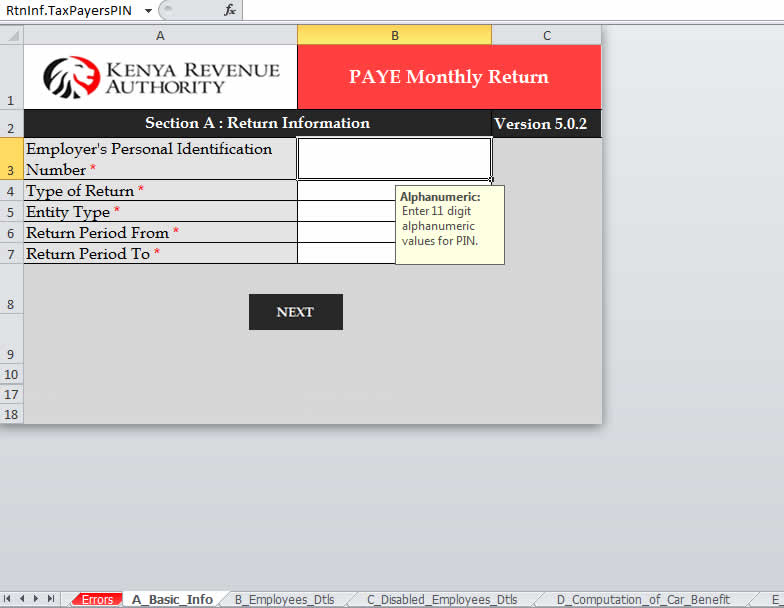

- Open your file named "P10_Return.xlsm" this is provided on the KRA online itax platform

- The first page is your basic information (e.g. return period, PIN number)

- Fill as required and click 'NEXT'.

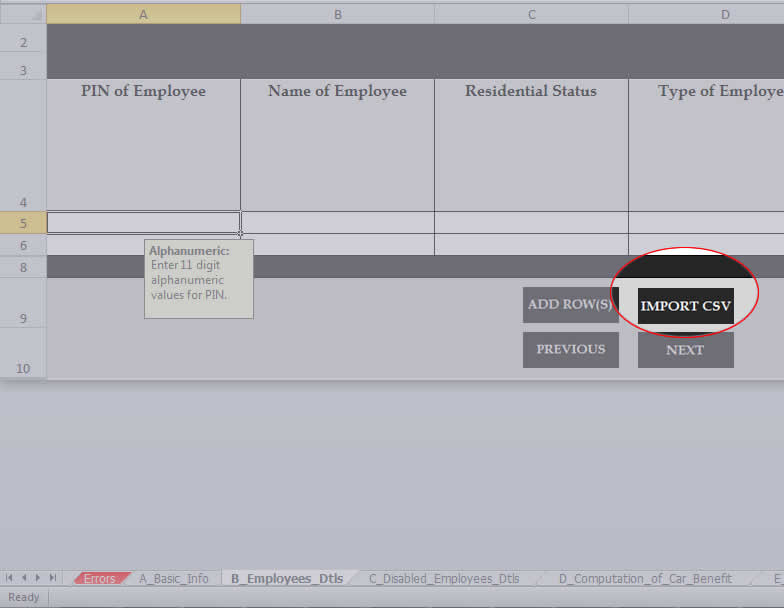

- This should bring you to the "Employee Details" section.

- Use the 'IMPORT CSV' button to import your csv file from Wingubox

- Your employee details with then be populated.

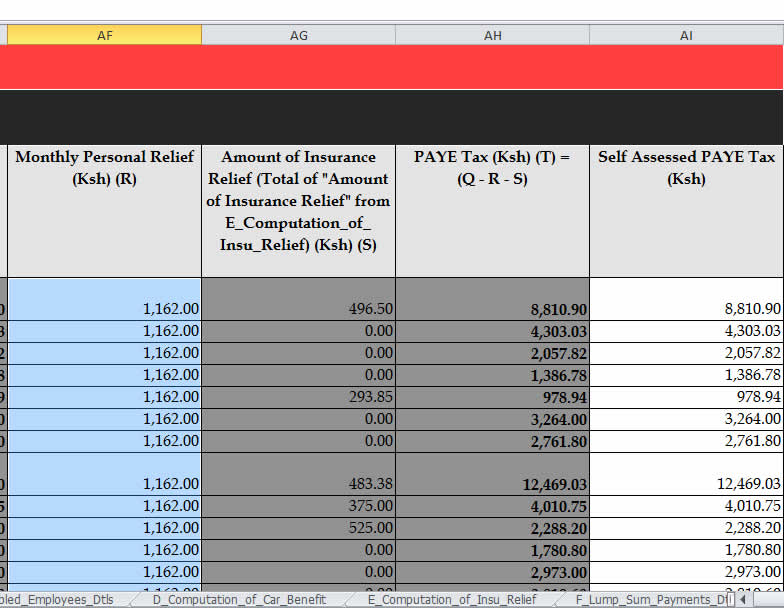

- Once uploaded peruse through the sheet to ensure everything is correct.

- Pay special attention to the last two columns, AH & AHI. These will show you KRA computed PAYE vs your own self-assessed PAYE from your Wingubox payroll.

Disabled Employee Details

This file contains all your employees with disability exemption.

On your Wingubox account, locate the blue button labeled “Export KRA Report” and select “iTax Disabled Employees”.

- Download and save the Wingubox generated csv file on your computer.

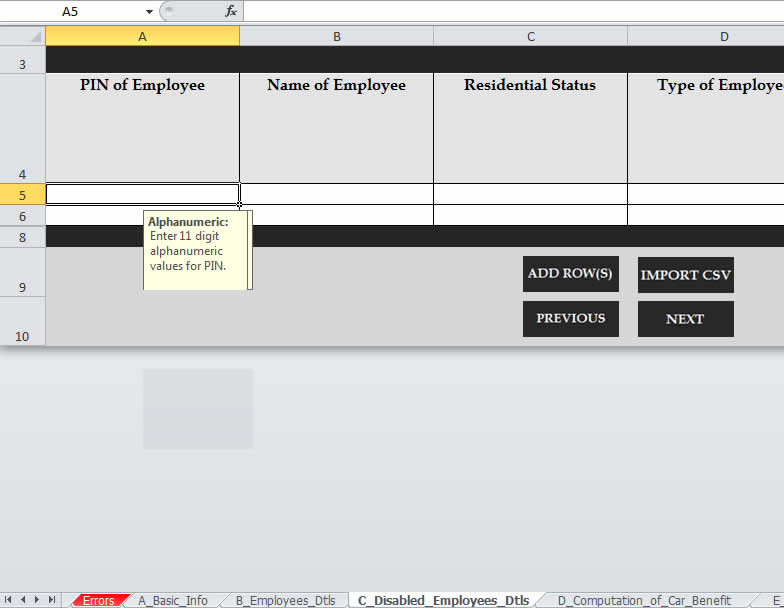

- On your iTax P10 spreadsheet, select the excel tab labeled C_Disabled_Employee_Dtls”

- Follow the same procedure as for “Employee Details”.

Common causes for errors would be:

- Missing Employee PIN number

- Missing Exemption Certificate Number

Other useful links:

Latest posts